- Courting Context

- Posts

- Wealth vs Capital

Wealth vs Capital

A semantic distinction for critical context

Why do 70% of wealthy families lose their fortune by the second generation?

They mistake wealth for capital, and that confusion is bankrupting our collective future.

Like two sides of a coin, wealth and capital appear inseparable, sometimes even interchangeable. Yet their distinct natures profoundly shape our lives, our societies, and even our deepest desires. Understanding this difference isn't just an intellectual exercise; it's a key to breaking free from extractive financial paradigms that drain your spirit while promising prosperity.

Wealth: Your Personal Treasury

At its heart, wealth is simply what you own: what remains after you spend.

Think of wealth as your personal treasury: a storehouse of resources that provides options, peace of mind, and the potential to channel resources toward greater good. It encompasses both the tangible (your home, art collection, that vintage guitar) and intangible (your skills, intellectual property, the deep wisdom you've cultivated through lived experience).

Historically, wealth took physical form: gold, silver, cattle, grain, wine.

Today, it includes financial assets: stocks, bonds, and other holdings that represent claims on real underlying value. These exist in a fascinating gray area between the concrete and abstract, essentially functioning as sophisticated IOUs that represent and substitute for something tangible elsewhere.

Many people confuse wealth with income, thinking high earnings automatically equal being rich. But income flows through time while wealth accumulates and holds. Spending that high income immediately actually reduces wealth, much like how short-term pleasures rarely build lasting happiness.

Here's what conventional finance doesn’t like to tell you: the relentless pursuit of material wealth often comes at the cost of genuine well-being, building anxiety faster than it builds contentment.

Capital: Wealth on a Mission (or Rampage)

If wealth is what you own, then capital is wealth with a singular obsession: infinite growth.

Capital is the active, dynamic face of wealth: assets specifically deployed to expand endlessly, to generate surplus value, to produce even more money through their own multiplication. This engine drives our modern economic system, and its prime directive for expansion shapes nearly everything about how that system operates.

As a shapeshifter in relentless pursuit of growth, capital disguises itself in surprising ways:

The Accumulation Engine: Capitalism by definition emphasizes accumulating capital and deploying it to turn human labor into commodity. This isn't a neutral process; it always extracts costs across our interconnected web of life. We have extensive historical examples of capital's intimate connection with exploitation systems, including slavery, which was treated as both fundamental wealth and capital investment. (Caitlin Rosenthal's Accounting For Slavery offers essential reading here.)

Flow Arbitrage Master: Modern capitalism operates through what philosophers Deleuze and Guattari call "generalized decoding of flows” — engineered streams of property, money, production, and workers remixed to extract profit and feed back into more capital production.

Financialization Evangelist: Today's "asset management capitalism" concentrates power in financial institutions through complex instruments like derivatives. Because we've applied human ingenuity toward financial wizardry rather than, say, land stewardship or ecosystem regeneration, financial assets have swelled to many times global GDP. This shifts our economy's center of gravity from tangible goods and services to highly abstract finance running on debt and "premised on cruel, racialized, long-term asymmetries of power."

The Invisibly Biased Hand: Capital operates with inherent bias toward its own endless growth and returns to wealth holders. This becomes institutionalized through corporate accounting and even language itself: profits (income flowing to capital) are "good" and maximized, while wages (income flowing to labor) are "expenses" to be minimized. This ensures absentee capital captures wealth even when worker productivity increases, at the worker’s expense.

Productivity Fetishist: The absolute development of social productivity, "production for production's sake,” still serves capital's limiting purpose: producing more capital. This demands converting everything from natural resources to human health to creativity into money to feed a machine making unrealistic claims upon reality itself.

The Shadow Work of Financial Healing

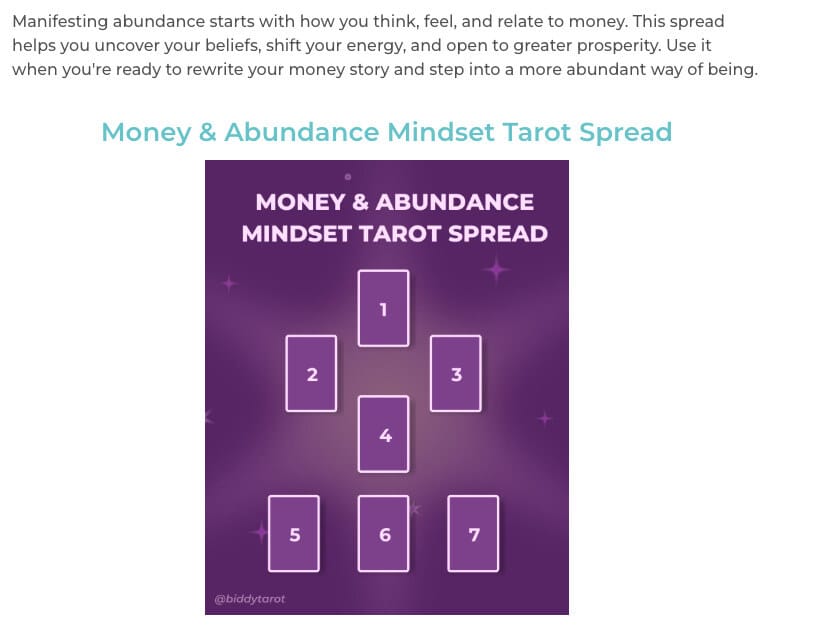

While navigating my own complex relationship with money during a career transition, I felt inspired called to the Thoth pocket tarot deck to pair with this money and abundance spread. My reading revealed something profound about how financial wounds shape our relationship with prosperity.

Here's what the cards revealed:

Current money mindset (Ten of Wands - Oppression): Carrying the crushing burden of financial responsibility alone, overwhelmed by the weight of survival anxiety, viewing financial security as something that requires struggle. In the Thoth tradition, this card represents oppressive force—the moment when ambition becomes self-defeating burden. (Byung-chul Han might clock this as a classic symptom of self-exploitation, as explored in Psychopolitics.)

Limiting belief blocking financial flow (The Star): Sometimes our highest aspirations become sophisticated forms of spiritual bypassing, keeping us from practical engagement with money, like avoidance masking as waiting for supposedly perfect conditions before acting, or daydreaming of a faraway future but failing to perceive what is real right now. Paradoxically, the Star’s limitless optimism can create paralysis when it prevents action grounded in context.

Belief origin story (8 of Disks - Prudence): This limitation was born from prudence, an excessive focus on skill-building and preparation that became a form of productive procrastination. Perfect preparation as a defense against financial vulnerability comes at its own costs, especially when inherited from early experiences where scarcity demanded hyper-vigilance. If prudence used to protect, it has calcified into limitation.

Truth to embrace (The Empress): The archetype of creative abundance, fertility, and generative power prompts a pivot from scarcity-driven accumulation toward wealth that naturally reproduces itself through alignment with creative life force. The Empress invites recognition of our inherent capacity to create value and nurture abundance through authentic expression (like tarot spreads in finance posts?)

Energy alignment with abundance (The Devil): Here's where it gets interesting. In Thoth symbolism, The Devil represents the creative force of nature, including shadow integration. Breaking free from the chains of scarcity thinking requires confronting what we’ve unconsciously bound ourselves to. True abundance requires embracing the full spectrum of desire and power, including ambitious previously judged or suppressed, to transform, rather than transcend, our relationship with money.

Practical step (The Chariot): Focused intention and disciplined action. The card of successful navigation through opposing forces, suggesting that abundance comes through skillful engagement with rather than avoidance of financial realities. Channeling the tension between prudence and boldness into forward momentum will create the balanced determination resulting in victory, rather than scattered effort.

Full embodiment potential (Adjustment): Perfect equilibrium; the dynamic balance that allows for sustainable prosperity aligned with justice and reciprocity, leveling extremes of both oppressive struggle and passive idealism to achieve sustainable abundance through balanced engagement.

This reading shows how even (especially?) those of us committed to heart-centered approaches to money can carry deep resistance to engaging with financial power. The shadow work we’re called to face with courage and compassion carries potent wisdom, whether we need to admit where spiritual ideals may come at the cost of

The Illusion of Limitlessness

Exploring the relationship between wealth and capital reveals uncomfortable realities posing as opportunities:

The Growth Trap: While we consider wealth ideally limitless, we're discovering hidden dangers of this mindset — much like facing consequences of limitless fossil fuel consumption. Capital's reproduction of "immanent limits" at unprecedented speed and scale creates a system with insatiable drive approaching insanity.

The Price of “Progress:” Growth of what, how, and for whom? What qualifies as wealth and capital in our current system comes at enormous cost to human dignity, our environment, and genuine well-being, but gets marketed as economic progress.

The Domination Paradox: Even successful capitalists become servants of the machine, driven by internalized infinite debt, absorbing surplus value not for personal enjoyment but to feed the machine's reproduction. Like cordyceps-infected ants, they become zombies in service of something that ultimately consumes them.

I came into this world after the fall of Bretton Woods, when Nixon untethered the US dollar from gold and birthed the behemoth of financialization: capitalism's current (and hopefully final) evolutionary form.

For me, money and financial systems have felt from the very start like an Advanced Dungeons & Dragons manual: unbearably pedantic and obscure yet simultaneously imaginal, undefinable, and magical.

Yet somehow, we're supposed to seek comfort and security from a system like this?

Understanding these distinctions — wealth as stored value versus capital as the force of infinite accumulation — becomes a critical step toward reclaiming agency.

For our earliest ancestors, wealth wasn't about asset accumulation or static hoarding. Nomadic lifestyles meant possessions were burdens. Instead, security came from deep engagement within interconnected webs of relationship (human and non-human alike) where status was gained through giving, not having.

Without the emphasis on individual ownership necessary for our current definition of wealth, something like true abundance takes shape: enough for many beyond the one. If capital is wealth on a rampage, putting its priorities ahead of everyone and everything else, then prosperity is wealth on a proper mission — pursuing abundance in context, in right relationship for the flourishing of all.

By examining embedded biases and recognizing the values fueling these systems, we can carefully reallocate resources and pivot toward designing systems that serve and sustain life rather than extract from and exploit it.

This shift from power-over to power-with paradigms transforms not just our financial strategies but our entire relationship with security, creativity, and interdependence.

How else could our relationships with money and power change by reframing wealth and capital as abundance and prosperity?